Risk is the “new normal” for

the global ocean shipping industry that handles 80% of global trade

as pressure from geopolitical tensions, rising protectionism and climate change

mounts.

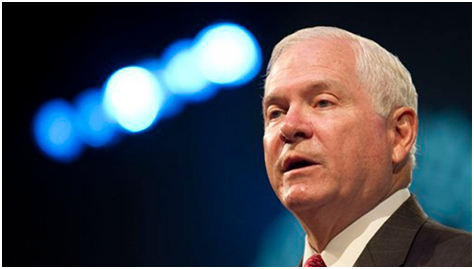

“There

are going to be global tensions … and I think global dangers, at a level we

haven’t seen since the end of World War II,” former U.S. Defense Secretary

Robert Gates said at the opening of S&P Global’s TPM24

containershipping conference in Long Beach, California, on Monday 4 March

’24.

Houthi

missile and drone attacks on merchant ships in the Red Sea and Gulf of Aden are

top of mind, but far from the only concerns, for the 4,000 attendees at the

conference that runs through Wednesday.

“The relatively relaxed environment

in which you have operated for a long time until fairly recently, is probably a

thing of the past for at least some considerable period,” Gates told the

audience.

The

ocean shipping industry entered this year with the highest degree of

risk in the 25 years that S&P Global Market Intelligence has been creating

that forecast, Chris Williamson, the company’s chief business economist, said.

Beyond

the Red Sea attacks, half of the world’s population is going to the polls this

year, which may bring more protectionist policies that include tariffs on major

exporters, such as China, he said.

That

trend, coupled with climate change-related costs, such as routing around the

drought-stricken Panama Canal, could fuel inflation that threatens a hoped-for

“soft landing” for the global economy, Williamson said.

The Red

Sea attacks already have spurred cargo delivery disruptions and soaked up

excess vessel capacity – raising shipping costs in what has been a

sluggish cargo volume recovery. Container

ship owners have been diverting vessels away from the Red Sea and the

nearby Suez Canal trade shortcut that handles as much of 30% of the world’s

container cargo – including clothing, furniture, auto parts, chemicals,

machinery and coffee.

The

longer, alternate route around Africa’s Cape of Good Hope adds five days or

more to trips and as much as $1 million in one-way fuel costs.

Spot shipping rates soared, doubling or tripling on some journeys,

and remain elevated.

Iran-affiliated

militants in Yemen have sunk one ship – the UK-owned Rubymar –

in their campaign that started in November and are undeterred despite

retaliatory attacks from a U.S.-British coalition and other navies. The Houthis last week vowed to down more ships in assaults they say are in solidarity

with Palestinians affected by Israel’s military actions in Gaza.