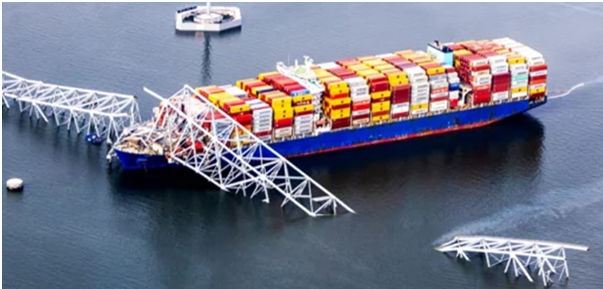

Data released today, Monday, 8 April by Xeneta, the ocean

freight rate benchmarking and intelligence platform, reveals average spot rates

from the Far East into the US North East Coast (including Baltimore) have

fallen slightly (-1%) since the bridge collapse on 26 March to stand at USD

5421 per FEU (40ft shipping container). When

including other US East Coast ports such as New York / New Jersey, rates from the

Far East have decreased by 3% in the same period.

Average spot rates from North Europe to the US North

East Coast have fallen by a larger 8% in the same period to stand at USD 2357

per FEU. When including other US East Coast ports, rates have decreased by 4%.

Peter Sand, Xeneta Chief Analyst, said:

“Spot rates have not reacted but that doesn’t mean shippers with cargo heading

to Baltimore are not affected – on the contrary they are seeing containers

arriving at ports they were not expecting.

“Ocean freight container shipping rates may

not have increased following the bridge collapse, but this incident is yet

another problem for shippers to handle on top of all the other disruptions

impacting supply chains at the moment, including the ongoing diversions in the

Red Sea region and drought in the Panama Canal.”

On Friday, 5 April, the Port of Baltimore issued an

update stating it expects to open a 280-feet wide and 35-feet deep federal

navigation channel by the end of April, followed by a reopening of the

permanent 700-feet wide and 50-feet deep channel by the end of May, restoring

port access to normal capacity.

While shippers will welcome a timeline for the

reopening of maritime lanes into Baltimore,

Sand believes importers into the US East Coast could be set for further

disruptions in 2024 due to labor negotiations.

The International Longshoremen’s Association’s

six-year contract with the United States Maritime Alliance, which represents

port terminal operators and ocean carriers on the East Coast, expires on 31

September – and no new agreement has yet been reached.